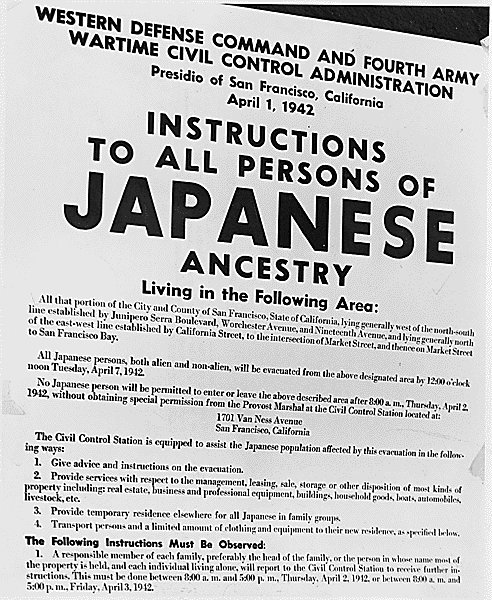

Japanese American Incarceration During World War II

Introduction I was not made aware of the internment of about 112,000 persons of Japanese ancestry who lived on the U.S. mainland, mostly along the Pacific Coast, until about 20 years ago. About two-thirds [...]