Ten years after the global financial crisis, the combined debt of sovereign governments, nonfinancial corporations and households has grown by $72 trillion to a total of $169 trillion, according to a briefing note from the McKinsey Global Institute.

The note, entitled “A Decade After the Global Financial Crisis: What has (and Has Not) Changed?” provided an overview of the global debt of governments, nonfinancial corporations and households, showing that we should worry whether central banks, regulators and policymakers have sufficient resources to deal with new crisis similar to 2008’s.

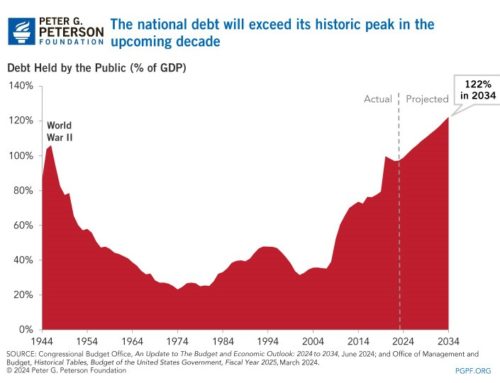

Indeed, instead of deleveraging, governments in advanced economies have borrowed heavily. Their debt on average represents 105 percent of Gross Domestic Product. Government debt now exceeds the annual GDP of Japan, Greece, Italy, Portugal, France, Spain and the United Kingdom. China’s debt, two and half times the size of its economy, is particularly troubling. By comparison, America’s national debt is about the size of its economy.

The growing sovereign debt in emerging economies, 46 percent of GDP, reflects their need to industrialize and urbanize. Argentina, Ghana, Indonesia, Pakistan, Ukraine and Turkey have recently felt economic pressure because much of their debt is denominated in foreign currencies and their local currencies have weakened.

Global nonfinancial debt, meaning the debt owed by households, government agencies, non-profit organizations or any corporation that is not in the financial sector, now is comparable in size to government debt.

We have two areas of concern: Two-thirds of the growth in corporate debt has originated from developing countries and much of that debt is denominated in dollars. The McKinsey Global Institute calculates that one-quarter of corporate issuers in emerging countries are at risk of default and that share could rise to 40 percent if interest rates rise by 200 basis points.

Corporate debt also has grown in advanced economies. To fund this increase, almost all borrowings have occurred through corporate bond issuance rather than from banks. The diversification away from banks should improve banks’ financial stability because they have lower leverage. Economists worry that the debt of Chinese companies has grown by 40 percent, some four times the rate of debt growth found in other advanced countries such as Western Europe and the U.S.

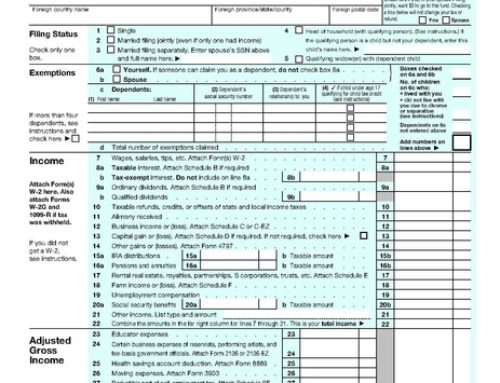

Unsustainable household debt in advanced countries was a major factor in the 2008 financial crisis. Before the crisis, home prices, low interest rates, and lax underwriting standards encouraged millions of Americans to take out bigger mortgages than they could safely afford. Defaults rose to a height of 11 percent of all mortgages in 2010.

U.S. households have reduced their debt by 19 percent of GDP over the past decade, but household financial strength remains worrying. In the United States, 40 percent of all adults surveyed by the Federal Reserve System said they would struggle to cover an unexpected expense of $400. One-quarter of non-retired adults have no pension or retirement savings. Outstanding student loans now top $1.4 trillion.

Some positives

• Tier 1 capital ratio has risen from less than 4 percent on average for U.S. and European banks in 2007 to more than 15 percent in 2017.

• The largest systematically important financial institutions have been required to hold a minimum amount of liquid assets.

• Most global banks have reduced the scale and scope of their trading activities.

Some negatives

• Return on equity for banks in Europe and U.S. has declined. U.S. banks’ return is 7.9 percent and European banks’ is 4.4 percent.

• The price-to-book ratio comparing the current market price to the book value of bank stocks has declined from about two times to less than one.

Other concerns

In addition to the large amount of debt of governments, nonfinancial corporations and households, I have other areas of concerns.

• High-speed trading by computers and algorithms could cause “flash crashes.”

• Cryptocurrencies’ growing popularity might have reached bubble-like conditions.

• Geopolitical tensions have disrupted long-standing relationships and incited nationalist movements that hinder global cooperation.

Originally published in the Sarasota Herald-Tribune