The Peter Peterson Foundation reported the following based on the June 18, 2024 CBO report.

Yesterday, the Congressional Budget Office (CBO) warned that the United States is on an unsustainable fiscal course marked by rising deficits. Debt and higher interest rates have pushed up interest payments, which threatens to crowd out other priorities. It’s critical that we act soon, because the Social Security and Medicare trust funds will both be depleted within a decade or shortly thereafter, which would result in automatic cuts to beneficiaries and in payments to healthcare providers.

Key Takeaways from the report:

-

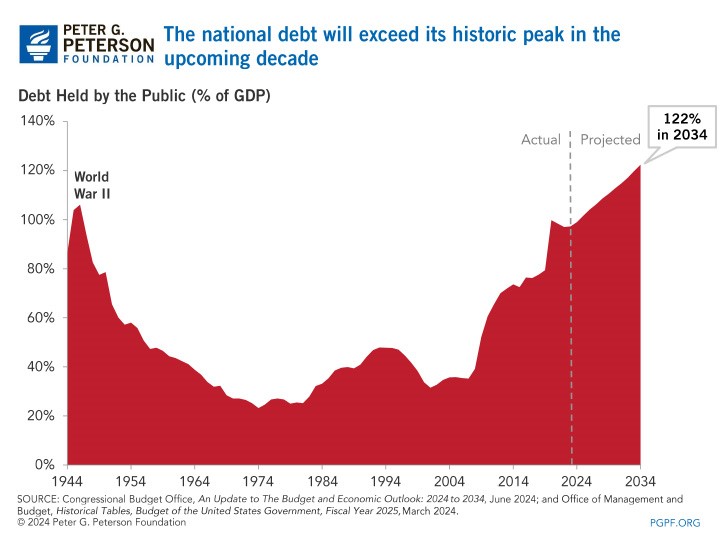

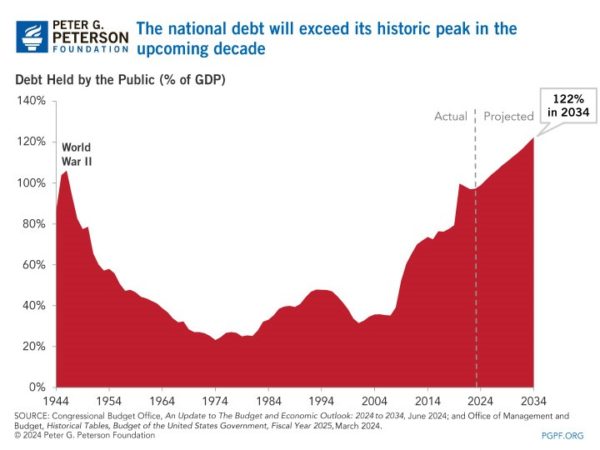

- In three years, the national debt will exceed its record high.

By 2027 the debt will cause the federal debt to rise above the nation’s all time high of 106.1%, which was reached just after World War II. The CBO projects that debt will continue rising, reaching 122% of GDP by 2034.

The national debt will exceed its historic peak in the upcoming decade.

- Deficits will remain high over the next 10 years.

CBO projects that the annual budget deficit will rise over the next 10 years, climbing from $1.9 trillion in 2024 to $2.9 trillion in 2034 — with spending exceeding revenues by more than one-third in that year. - Short and Long-term interest rates are expected to decrease by the end of the decade

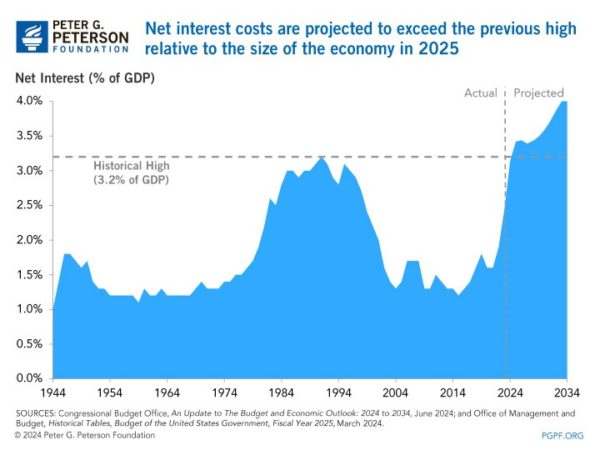

To address high inflation, the Federal Reserve has increased the Federal Funds rate to between 5.25 and 5.5 percent; as a result, the rate on 3-month Treasury bills rose substantially over the past two years. CBO expects that rate to remain stable at 5.2 percent in calendar year 2024 before eventually dropping to 2.8 percent in 2028. CBO expects that the 10-year Treasury rate will average 4.5 percent this year, up from 3.0 percent a couple years ago. The agency projects that such rates will fall to 3.6 percent by 2027 and then gradually rise to 4.1 percent in 2032, where it will remain through the remainder of the projection period. - Interest costs have spiked.

CBO expects that interest costs will be more than twice as high this year as they were just three years ago — rising from $352 billion in 2021 to $892 in 2024. Going forward, interest costs are projected to grow further and reach $1.7 trillion in 2024.

Net interest costs are projected to exceed the previous high relative to the size of the economy in 2025.

- Social Security and Medicare are key factors in spending growth.

Driven by an aging population and rising healthcare costs, federal spending on major healthcare programs (Medicare, Medicaid, premium tax credits and related spending, and the Children’s Health Insurance Program) would increase from 5.6 percent of GDP in 2024 to 6.8 percent in 2034. Spending for Social Security will also rise over that period, from 5.1 percent of GDP in 2024 to 6.0 percent in 2034. - The major trust funds are expected to be depleted within the next decade or shortly thereafter.

CBO projects that the balance of Social Security’s Old-Age and Survivors’ Insurance (OASI) Trust Fund will be depleted in 2033. In addition, CBO’s numbers indicate that Medicare’s Hospital Insurance (HI) Trust Fund will be depleted shortly after the projection window. At the time of depletion for each trust fund, the corresponding program will be unable to pay its full obligations. The Highway Trust Fund is projected to be depleted in 2028. - Tax Revenues will not keep pace with the growth in outlays.

CBO anticipates that such receipts will stabilize at nearly 18 percent of GDP from 2026 to 2034, which will not be sufficient to cover the growth in outlays over the period. Additionally, CBO’s projections assume that certain individual income tax provisions of the 2017 tax law that are set to expire at the end of 2025 will actually expire. To the degree that lawmakers extend any of these provisions without offsets, our fiscal situation will be that much worse. - The fiscal outlook has worsened over the past four months.

CBO projects that cumulative deficits will total $22.1 trillion over the next 10 years — 10 percent higher than their projections four months ago. Most of the higher projected deficits result from additional appropriations provided since CBO’s previous report; much of that spending stems from supplemental funding to provide aid to Ukraine, Israel, and other countries.

- In three years, the national debt will exceed its record high.