The Wall Street Journal provided an overview of the income tax paid by Americans, broken down by income.

Our nation is on an unsustainable fiscal path, driven by the mismatch between the government’s commitments and its revenues. The Congressional Budget Office (CBO) projects that federal outlays will climb from 23.1% of Gross Domestic Product (GDP) in 2024 to 27.4% in 2054. The CBO projects that revenues will rise only slightly to 18.8% of GDP. Clearly, America cannot sustain this discrepancy between expenditures and revenue. To the extent that we wish to raise revenues, a major question is what is a group’s fair share?

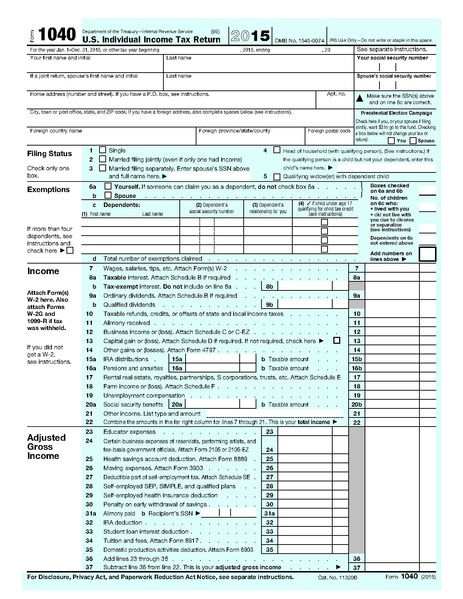

The bottom half of earners, about 76.8 million returns, reported adjusted gross income up to about $46,500. In tax year 2021, they earned 10.4% of the country’s total income, while paying 2.3% of all income taxes. Their average tax rate was 3.4%.

The next group is between the bottom half and the top 25% of earners, a total of 38.4 million returns. They showed earnings from about $46,500 to $94,500. They reported 17.5% of income, while paying 8.4% of income taxes. Their average tax rate was 7.2%.

The next group is between the top 25% and 10%, or 23 million returns, had earnings from about $94,500 to $170,000. They reported 19.5% of income, paid 13.4% of taxes, and had an average tax rate of 10.3%.

Between the top 10% and 5% were 7.7 million returns with earnings from about $170,000 to $253,000. They reported 10.6% of income, paid 10.2% of income taxes, and had an average tax rate of 14.3%.

Between the top 5% and 1% were 6.1 million returns with earnings from about $253,000 to $682,500. They reported 15.7% of income, paid 19.9% of all income taxes, and had an average tax rate of 18.9%.

Finally, we come to the top 1%, another 1.5 million returns with earnings in excess of about $682,500. Their share of income taxes paid was 45.8%, not quite double their share of income. Their average tax rate was 25.9%. Among the tippy-top 0.1%, or 154,000 returns with earnings above about $3,775,500 a year, the average tax rate was similar, 25.7%.