Introduction

The debate over whether the wealthiest Americans pay their fair share of taxes has become a significant political issue. I believe that America cannot continue to sustain $ trillion-dollar deficits. Therefore, taxes will need to be raised. The debate should focus on what is fair to all economic groups, not just those in the higher income tax brackets.

Main

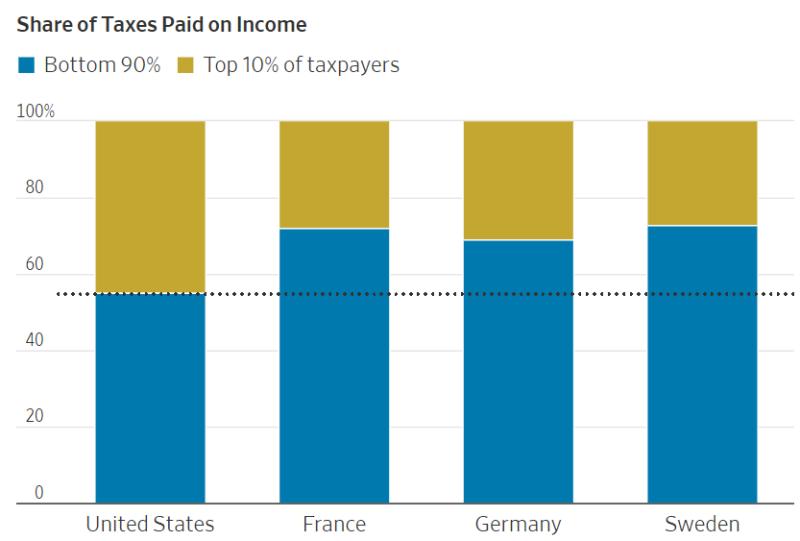

The Organization for Economic Cooperation and Development showed that the top 10% of Americans earn about 33.5% of all earned income, but pay 45.1% of all income taxes, including Social Security and Medicare payroll taxes. The progressivity ratio of 1.35 is higher than other developed countries.

| Country | Progressivity Ratio |

| United States | 1.35 |

| France | 1.1 |

| Germany | 1.07 |

| Sweden | 1.00 |

The Top 10% of Americans pay a higher percentage of taxes than other leading European countries.

| Country | Percentage Payment of Taxes by Top 10% |

| United States | 45% |

| France | 28% |

| Germany | 31% |

| Sweden | 27% |

The Joint Committee on Taxation and the Congressional Budget Office found that the 2017 tax cuts made American tax system more progressive.

Percentage of taxes (Federal, State, and Local) by quintile

| Bottom | 7.5% |

| Second | 14.1% |

| Middle | 22.7% |

| Fourth | 28.4% |

| Top | 40.9% |

Since the War on Poverty started in 1965, the labor-force participation rate of bottom-quintile earners, who now receive more than 90% of their $50,000 average income from government transfer payments, has fallen from almost 70% to 36%. Diverse industries from oil to healthcare and everything in between, are having a difficult time attracting workers for less than $20 per hour.

Conclusion

The fiscal irresponsibility of both political parties is going to cause major problems in future years. Our national debt of $30 trillion is expected to rise to $40 trillion by 2031.

The Pollyanna hope that interest rates will not increase because the government cannot pay the interest on the debt is a deception. Interest rates are set by global market forces. If confidence in the U.S. dollar wanes, then investors will either invest abroad or demand higher returns, especially if the inflation rate remains around 5%.

If the interest rate on the 10-year treasury were to rise to 5%, which is below its average during my trading career (1969-2004), interest costs will be $2 trillion dollars, one half of current revenues. Stated differently, interest costs will crowd out many governmental programs.

If current Modern Monetary Theory is correct in stating that deficits do not matter, then my undergraduate degree in economics, my master’s degree in economics and my MBA are worthless.