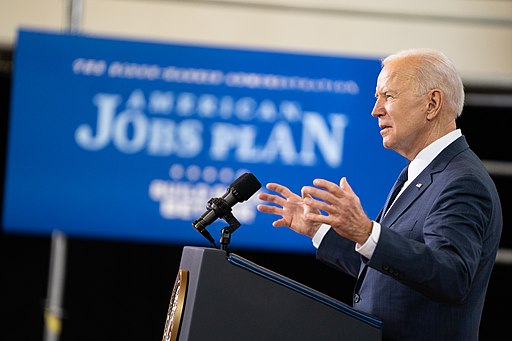

The Biden Administration is evaluating a variety of possible tax increases, including boosting the corporate tax rate and the top marginal income-tax rate on wealthy individuals in order pay for its infrastructure, antipoverty measures and education agenda (Build Back Better).

Build Back Better will cost approximately $ 3 trillion. One focus will highlight infrastructure—roads, bridges, and water systems. The other objectives are education and antipoverty programs.

To fund partially Build Back Better, the Administration favors breaking the tax plan into two pieces. Initially, Democrats favor paying for the infrastructure program by raising the corporate tax rate up to 28% from the current 21%. To pay for their antipoverty and education agenda, they favor increasing the marginal tax rate of people earning over $400,000 from 37% to 39%.

Although details remain cloudy, the Biden Administration is considering applying a capital-gains tax on appreciated assets at death, ending the so-called “stepped-up-basis.”

Democrats recognize that raising taxes, especially with our economy just starting to recover is problematic. Representative Mark Pocan (D. Wis) said: “Trying to tie something as big as real tax reform to this (Infrastructure Program) would just bog down the process and not get funding out to the economy as quickly as necessary.”

Representative Kevin Brady (R., Texas) said, “To fuel special interest spending, President Biden will use any excuse to tax away more of the earnings of American workers, families, and small businesses.”

Mac Campbell, a former Democratic aide on the Senate Finance Committee summed up the status quo: “Both the amount and makeup of any tax provisions in the infrastructure package are going to be determined by what moderate Democrats in the Senate can stomach.”

Until now, the three major stimulus programs enacted to combat the economic damages caused by the pandemic have been funded by expanding federal borrowing.

- March 2020–$ 2 Trillion

- December 2020–$ 900 Billion

- March 2021–$1.9 Trillion

The Brookings Institute issued a report, “How worried should you be by the federal deficit and debt?” that highlighted the extent of our growing federal deficits.

- At 17.9% of GDP in Fiscal Year 2020 ($3.7 Trillion), the federal deficit is almost twice as large than we incurred during the Great Recession (2007-2009).

- The federal debt, measured against the size of our economy now exceeds our GDP, a very troubling statistic.

- The U.S. government spends as much on interest as the combined budgets of Commerce, Education, Energy, Department of Homeland Security, HUD, Interior, Justice and State

While nobody knows at what level our government’s debt will begin to hurt the economy, economists worry that the size of our debt will limit the flexibility of the U.S. government to confront future financial crises. Before the Great Recession, federal debt was about 35% of GDP. According to private sector projections federal debt will approach 120% of GDP by 2030.

Federal debt cannot grow faster than the economy indefinitely. Eventually private borrowing will be crowd out if the government’s debt continues to grow and interest rates rise.

The prospect of sizable tax increases for everyone, not just corporations and wealthy individuals, is a distinct possibility in the intermediate term.

If America does not get its fiscal house in order, we could experience stagflation similar to our experience in the late 1970’s to 1980’s. Stagflation is a situation where the inflation rate is high, economic growth slows, and unemployment remains steadily high. A combination of the government printing money, a significant increase in the money supply, and demand exceeding supply can cause stagflation.

It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

Originally published in the Sarasota Herald-Tribune